All Categories

Featured

Table of Contents

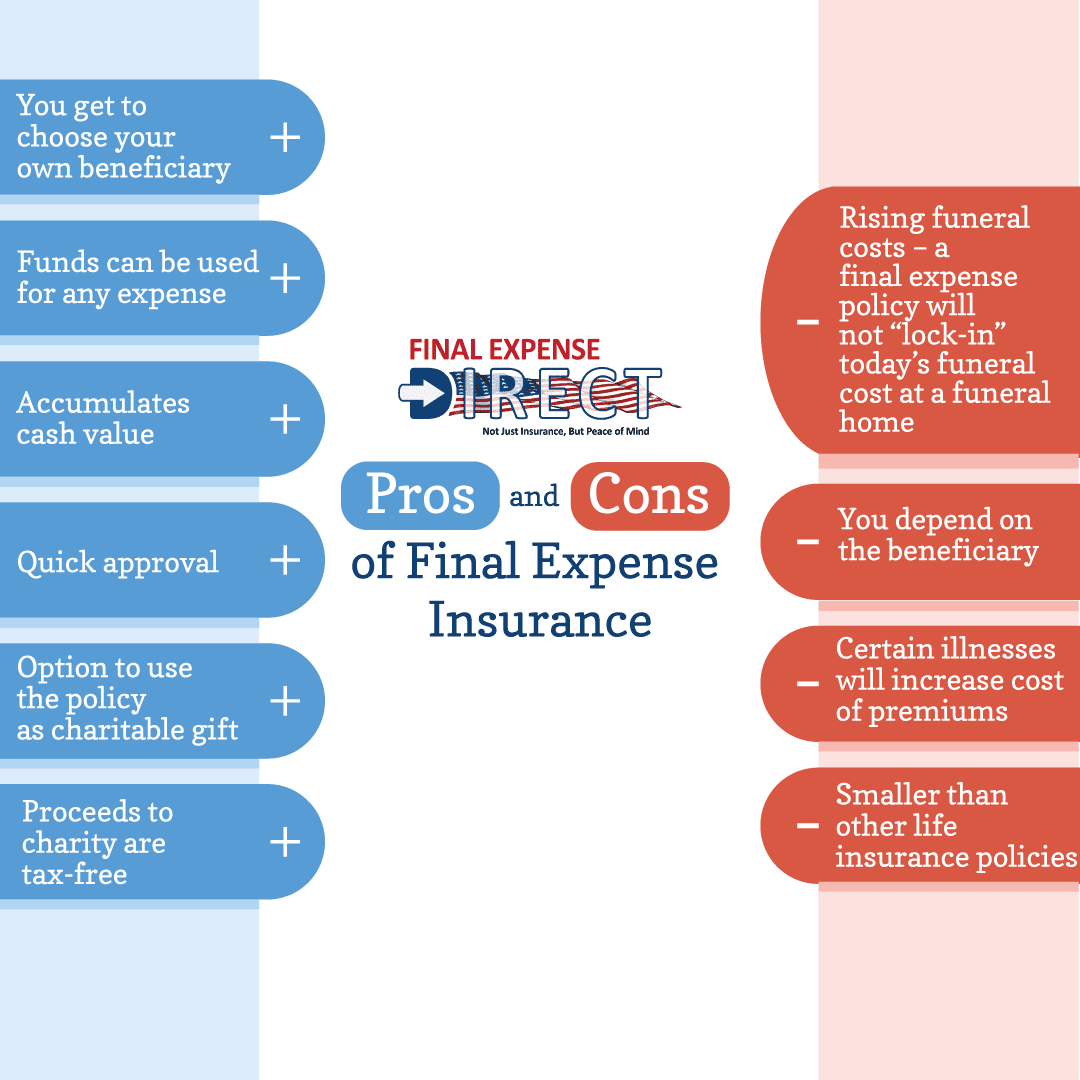

Simply like any various other irreversible life plan, you'll pay a normal costs for a final expense policy for an agreed-upon fatality benefit at the end of your life. Each carrier has different rules and alternatives, however it's fairly easy to handle as your beneficiaries will certainly have a clear understanding of how to invest the money.

You may not need this kind of life insurance policy. If you have long-term life insurance in position your final expenditures might currently be covered. And, if you have a term life plan, you might have the ability to convert it to a long-term policy without several of the extra steps of obtaining final expense protection.

Created to cover minimal insurance policy needs, this type of insurance policy can be a budget-friendly option for individuals that simply want to cover funeral prices. (UL) insurance stays in place for your entire life, so long as you pay your costs.

Aarp Burial Life Insurance

This option to final expenditure insurance coverage supplies alternatives for added household protection when you require it and a smaller sized insurance coverage quantity when you're older.

Final costs are the costs your household pays for your burial or cremation, and for various other points you might desire at that time, like an event to commemorate your life. Thinking concerning last costs can be hard, knowing what they set you back and making certain you have a life insurance coverage plan huge adequate to cover them can aid spare your family members an expenditure they may not have the ability to afford.

Expenses Of Insurance Companies

One choice is Funeral Preplanning Insurance which allows you select funeral products and services, and money them with the acquisition of an insurance plan. An additional choice is Last Expenditure Insurance Coverage.

It is projected that in 2023, 34.5 percent of families will select funeral and a higher percentage of households, 60.5 percent, will certainly choose cremation1. It's estimated that by 2045 81.4 percent of households will choose cremation2. One reason cremation is becoming extra preferred is that can be less pricey than funeral.

Funeral Cost Insurance Policy

Depending upon what your or your family desire, things like funeral plots, severe markers or headstones, and caskets can enhance the price. There may also be costs along with the ones especially for burial or cremation. They could include: Treatment the expense of travel for household and liked ones so they can participate in a service Provided dishes and other expenditures for a party of your life after the service Acquisition of unique clothing for the solution As soon as you have a good idea what your final expenses will be, you can assist prepare for them with the best insurance plan.

Medicare only covers medically needed costs that are required for the diagnosis and therapy of an ailment or condition. Funeral expenses are ruled out medically essential and therefore aren't covered by Medicare. Last cost insurance offers a simple and reasonably affordable way to cover these costs, with plan benefits ranging from $5,000 to $20,000 or more.

People usually acquire final cost insurance policy with the intent that the beneficiary will use it to pay for funeral prices, arrearages, probate fees, or various other related expenditures. Funeral costs might include the following: Individuals usually ask yourself if this sort of insurance coverage is necessary if they have cost savings or various other life insurance policy.

Life insurance policy can take weeks or months to payment, while funeral service expenditures can start including up instantly. The recipient has the last say over just how the money is utilized, these plans do make clear the insurance holder's intention that the funds be used for the funeral and relevant prices. People usually buy irreversible and term life insurance policy to help give funds for recurring expenditures after an individual passes away.

What's The Difference Between Life Insurance And Funeral Insurance

The most effective means to make certain the plan quantity paid is invested where meant is to name a beneficiary (and, in some situations, a secondary and tertiary beneficiary) or to place your wishes in a surviving will certainly and testimony. It is often a great technique to alert main recipients of their expected responsibilities when a Last Cost Insurance coverage policy is gotten.

Premiums begin at $22 per month * for a $5,000 coverage policy (costs will differ based on problem age, gender, and coverage quantity). No medical exam and no health concerns are needed, and consumers are guaranteed protection via automatic certification.

Listed below you will find some frequently asked questions should you select to use for Final Cost Life Insurance Policy by yourself. Corebridge Direct licensed life insurance policy representatives are waiting to respond to any type of extra questions you might have pertaining to the protection of your enjoyed ones in the event of your death.

The kid cyclist is bought with the concept that your child's funeral service expenses will certainly be completely covered. Child insurance cyclists have a death benefit that varies from $5,000 to $25,000.

Burial Insurance Life

Note that this policy just covers your kids not your grandchildren. Final expense insurance plan benefits don't finish when you sign up with a plan.

Motorcyclists come in various types and offer their own advantages and incentives for joining. Motorcyclists are worth looking right into if these supplementary choices apply to you. Bikers include: Faster death benefitChild riderLong-term careTerm conversionWaiver of costs The increased fatality benefit is for those who are terminally ill. If you are seriously sick and, relying on your particular policy, figured out to live no more than 6 months to two years.

The Accelerated Death Advantage (for the most part) is not strained as revenue. The drawback is that it's going to decrease the survivor benefit for your recipients. Obtaining this also calls for proof that you will not live previous 6 months to two years. The youngster rider is bought with the notion that your kid's funeral service expenditures will certainly be completely covered.

Protection can last up till the youngster turns 25. Note that you might not be able to authorize your child up if he or she suffers from a pre-existing and deadly problem. The lasting care motorcyclist is similar in concept to the accelerated survivor benefit. With this one, the concept behind it isn't based on having a short amount of time to live.

Selling Final Expense

This is a living benefit. It can be obtained versus, which is extremely helpful since lasting treatment is a significant cost to cover.

The motivation behind this is that you can make the button without being subject to a medical test. And given that you will no much longer get on the term plan, this likewise suggests that you no more need to bother with outlasting your plan and shedding out on your fatality advantage.

Those with existing health and wellness conditions may experience higher premiums or limitations on insurance coverage. Keep in mind, policies generally cover out around $40,000.

Consider the regular monthly premium repayments, however additionally the peace of mind and financial safety and security it supplies your family members. For many, the reassurance that their loved ones will not be strained with monetary difficulty throughout a challenging time makes final expenditure insurance policy a worthwhile financial investment. There are two kinds of last expense insurance policy:: This type is best for people in fairly healthiness that are searching for a means to cover end-of-life expenses.

Protection amounts for streamlined concern plans usually increase to $40,000.: This type is best for people whose age or health and wellness avoids them from buying various other sorts of life insurance policy protection. There are no health and wellness requirements in any way with guaranteed problem plans, so anyone who meets the age demands can normally qualify.

Below are some of the variables you ought to take into consideration: Assess the application process for different policies. Make sure the carrier that you choose offers the amount of coverage that you're looking for.

Table of Contents

Latest Posts

Group Term Life Insurance Calculator

Final Expense Agency

Final Care Solutions

More

Latest Posts

Group Term Life Insurance Calculator

Final Expense Agency

Final Care Solutions